Mixed performance in reaching SEE 2020 targets

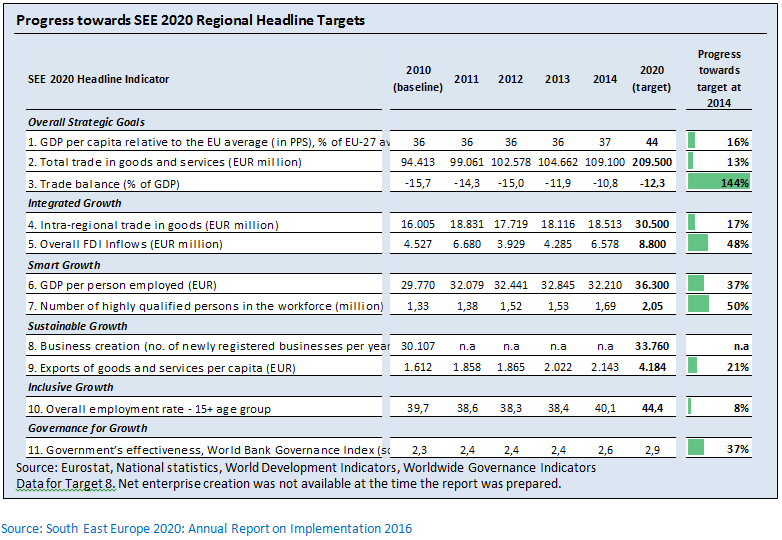

The implementation of the SEE 2020 Strategy started in the aftermath of the largest global economic crisis in recent history which had a particularly negative impact in the SEE, reversing many of the gains achieved during the 2000s. The region has witnessed its economies contract, employment and investment plummet, and its financial sector at dire risk. The narrowing fiscal space and limited scope for monetary policy interventions considerably reduced the policy options and instruments at the governments’ disposal. Against this backdrop, the governments have moved forward with numerous reforms to reach the ambitious regional SEE 2020 targets and, so far, the progress has been fairly mixed (see table above).

Improving trade balance, education and FDI all met or exceeded expectations

In some areas, such as balancing trade (target 3), the target has already been met and exceeded by the region. Stronger demand from the EU market, the region’s main trading partner, has been the key driver behind this rebalancing over the past two years. The region's trade deficit narrowed from 15.7 percent of GDP in 2010 to 10.8 per cent in 2014, with the trend continuing in 2015. Considerable progress has also been made in attracting foreign direct investment (target 5) and enhancing the educational profile of the workforce (target 7), and the region is roughly halfway towards meeting the targets in these two areas.

Moderate progress was attained in increasing productivity (using Target 6 as a broad proxy) and improving governance (Target 11, each recording a 37 per cent increase towards meeting the set target for 2020.

Employment remains the most critical issue

Only minor progress was recorded by the targets measuring growth, convergence with the EU, trade expansion and employment, the key underlying targets of the Strategy (Targets 1, 2, 4, 9 and 10). Although growth prospects have improved with analysts forecasting a healthier 2.9% regional growth rate on average until 2020 (compared to only 0.6% in the 2010-15 period), the target of reaching 44 per cent of EU GDP per capita average will likely remain elusive. Similarly, even with external demand picking up, the region’s trade would still have to expand at an unprecedented annualised rate of 11.5 per cent to reach the EUR 209.5 billion target. This is hardly realistic under the existing growth scenarios. Finally, the regional employment target reveals very little progress on job creation, the central tenet of the SEE 2020 Strategy. While the negative employment trend has been reversing over the past two years, the number of jobs created so far has barely offset the jobs lost in the 2010–13 period. In order to reach the 2020 target of 44.4 per cent employment rate (15+ age group), the economies of the region would need to add between 150–170 thousand jobs annually over the next five years. Based on the current growth scenarios and in the absence of larger-scale investment, this seems unlikely.

Region should step up reform efforts

As noted also in last RCC’s Annual Report on Implementation, SEE 2020 accomplishments have thus far been a mixed bag, with encouraging progress in some areas, but also disappointing developments in others. It’s impossible to attribute these developments, positive or negative, solely to the work of our governments – our economies are so closely connected with the EU and global markets that any shift in external markets and business cycles are bound to impact our region regardless of the governments’ track records. While it’s important to keep this in mind, it has to be noted that more can and should be done. Governments should step up their efforts in creating more enabling environment for doing business, more flexible labour markets and better public administrations. Profound improvements to regional stability and strengthening the rule of law will be crucial if we are to mitigate risks that stand in the way of improved investment prospects.

Our citizens expect this, and they are growing restless. In the last Balkan Barometer survey done by the Regional Cooperation Council, more than 73% of citizens stated they are dissatisfied with the general economic situation in their economies, while 43% would consider leaving their home and working abroad. Interestingly, the sentiments towards the EU are also changing for the worse – majority of citizens responded that for them, EU membership is either a bad thing (20%), or neither good nor bad (36%).